To mitigate the limitations of standalone models and harness their combined strengths,

MuRong Technology has pioneered the "Fusion" Model—a hybrid approach integrating the agility of the Greenfield Model with the stability of the Upgrade & Optimization Model.

This solution offers banks a balanced path to digital transformation, ensuring both speed and continuity.

MuRong IDO (An Innovative and Open Digital Banking System), MuRong’s digital banking system,

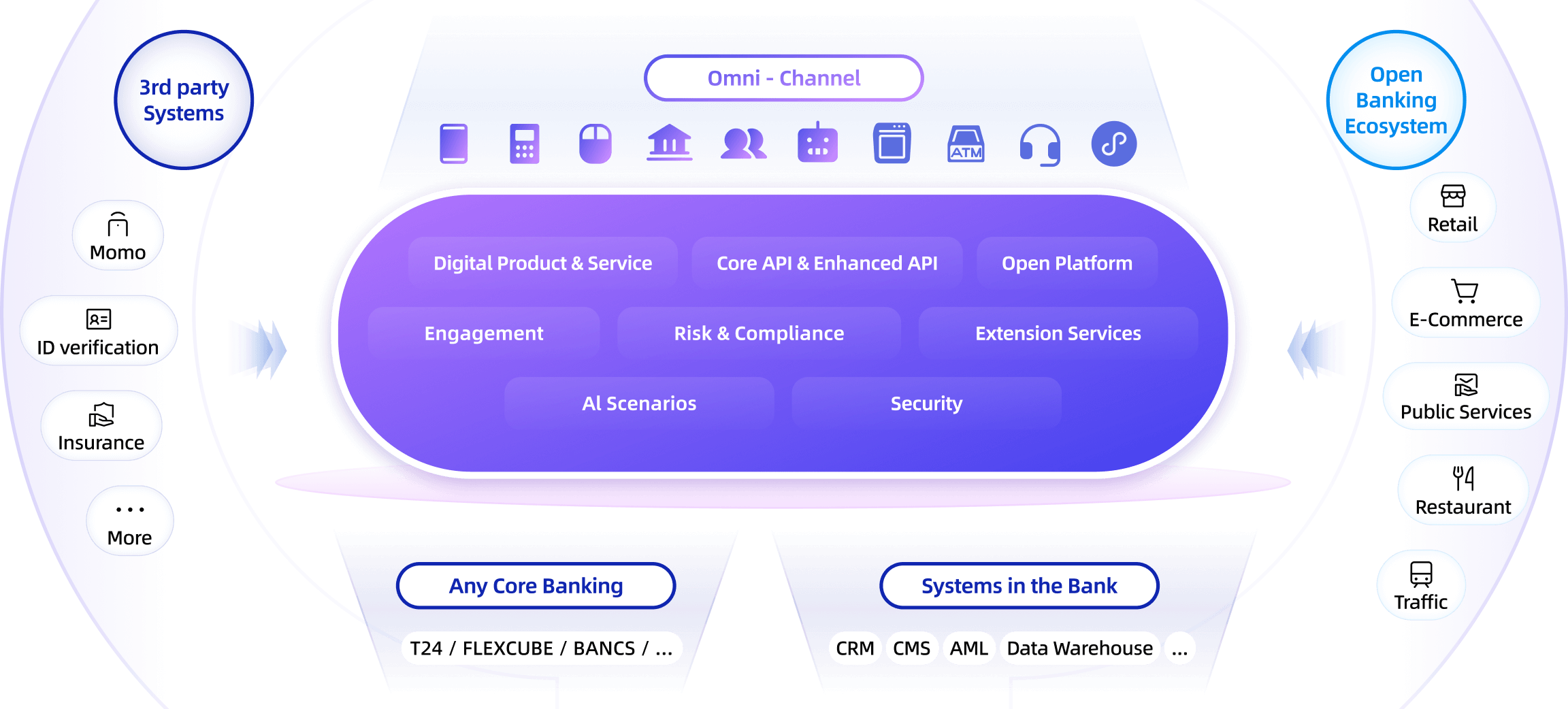

embodies the Fusion Model. It supports omni-channel digital banking while retaining the rapid deployment advantages of Greenfield projects.

By seamlessly integrating with any core banking systems, it reduces operational complexity, safeguards business continuity and elevates customer experience.

Proven in practice, MuRong IDO is ideal for banks seeking to modernize swiftly without destabilizing their core infrastructure.

MuRong IDO delivers comprehensive digital banking solutions encompassing core products, services and multi-channel capabilities including mobile banking, online banking and an open API platform. Built on a distributed microservices architecture, the platform addresses diverse needs—from infrastructure setup to product innovation, intelligent operations and risk management—while ensuring scalability for future growth.

why

choose us?

Cutting-Edge

Technology

Distributed microservices architecture with high availability, elastic scalability and embedded AI engines for advanced analytics.

Sustainable Business

Innovation

Provide a robust digital innovation platform, Including Online Account Opening, Online Deposits, Digital Lending, Payments and more.

Exceptional

Experience

Exceptional Customer Journey and Seamless Omni-channel Experience, Including Core Banking System, Super App, Online Banking, Gateways, Open Banking.

Key features

of

MuRong IDO

Omni-Channel Experience

IDO integrates all online and offline touchpoints (APP, USSD, web) to cover the entire customer lifecycle journey, including account opening, transfers, loan applications, and investment services. This ensures consistency across channels and effortless connectivity.

Enhanced Innovation Components

IDO offers a rich set of product components that enhance the capabilities of existing core banking system, supporting continuous innovation in digital banking services.

Seamless Integration with Global Core Systems

IDO supports seamless integration with major international core banking systems Seamlessly integrate with various global core banking systems through adapted interfaces, while also supporting connections to third-party platforms for payments and authentication.

AI-Powered Intelligence Suite

Integrated AI tools provide intelligent customer service, marketing, risk management, and operational efficiency, along with precise marketing capabilities.

Open Banking & Ecosystem

IDO’s Open Banking capabilities support secure real-time integration with third-party providers via standardized APIs. By collaborating with external partners, banks can deliver value-added services, expand cost-effectively and foster innovation.

Automatic Operation

Automated reconciliation, error processing, reporting, risk control, chatbot, and monitoring with automated alerts.

Layered Security

With a multi-layered security architecture that meets international standards, IDO offers end-to-end encryption and comprehensive protection for data and business operations.

Our

product

Benefits

Flexible On-Demand Purchasing Model

Banks can select digital functionality products based on their needs, budget and timeline. This “on-demand and phased implementation” approach enables quick launches and seamless expansion of new products, significantly reducing transformation complexity and risk.

Optimized ROI Model

With an "on-demand and agile" strategy, IDO enables banks to invest wisely in high-value modules. This approach improves efficiency and reduces costs within 6-12 months, while simplifying coordination between new and legacy systems and lowering collaboration costs across departments.

Future-Proof Technical Architecture

IDO adopts a distributed microservices architecture with containerized deployment solutions, seamlessly integrating AI capabilities to meet enterprise digital transformation needs while ensuring a future-proof design for technological evolution over the next 5–10 years.

Rapid Omni-Channel Release

With a unified product management framework, IDO allows for "one-time release, synchronized across all channels," significantly reducing launch times for mobile banking, online banking, and other digital channels.

Global Digital Banking Support

Comprehensive support for global operations, including:

Multi-language capabilities

Multi-theme management

Cross-timezone service assurance

Our product

Benefits

Flexible On-Demand Purchasing Model

Banks can select digital functionality products based on their needs, budget and timeline. This “on-demand and phased implementation” approach enables quick launches and seamless expansion of new products, significantly reducing transformation complexity and risk.

Optimized ROI Model

With an "on-demand and agile" strategy, IDO enables banks to invest wisely in high-value modules. This approach improves efficiency and reduces costs within 6-12 months, while simplifying coordination between new and legacy systems and lowering collaboration costs across departments.

Future-Proof Technical Architecture

IDO adopts a distributed microservices architecture with containerized deployment solutions, seamlessly integrating AI capabilities to meet enterprise digital transformation needs while ensuring a future-proof design for technological evolution over the next 5–10 years.

Rapid Omni-Channel Release

With a unified product management framework, IDO allows for "one-time release, synchronized across all channels," significantly reducing launch times for mobile banking, online banking, and other digital channels.

Global Digital Banking Support

Comprehensive support for global operations, including:

Multi-language capabilities

Multi-theme management

Cross-timezone service assurance